Diabetes is a chronic health condition that has a wide-ranging impact on your health, and your vision isn’t exempt.

Annual diabetic eye exams play a crucial role in preventative vision care by detecting potential diabetic-related visual changes early, helping to safeguard your eyesight.

Most insurance plans prioritize preventative care, such as diabetic eye exams, often covering part, most, or even the entire cost of the visit.

Financial barriers to healthcare negatively affect our overall health and wellness. Our approach to vision care aims to accommodate all budgets, regardless of whether you have or don’t have insurance coverage.

All About Diabetic Eye Exams

Diabetes is a chronic condition that affects how well your body processes blood sugar, also known as glucose.

It develops when the pancreas doesn’t produce enough insulin or when the body cannot effectively use the insulin it makes.

Over time, high blood sugar levels can damage various parts of the body, including our eyes.

What Is a Diabetic Eye Exam?

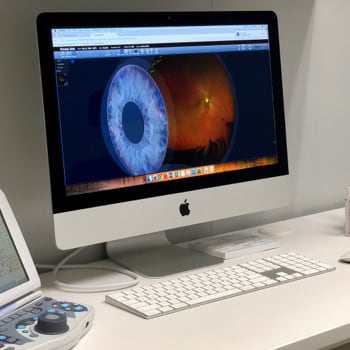

Diabetic eye exams help optometrists monitor visual changes associated with diabetes.

While routine eye exams focus on general vision and health concerns, diabetic eye exams focus on assessing your visual health concerning any diabetic changes to the eye’s internal structures.

Diabetes is notorious for silently wreaking havoc on various parts of the body, including your eyes. Some people may be unaware they even have this condition. This highlights the importance of routine eye exams, which also screen for general health conditions like diabetes.

Having diabetes increases your likelihood of developing eye conditions, such as:

- Diabetic Retinopathy: High blood sugar levels can cause swelling or leakage in the retina’s blood vessels, leading to damage over time. This can lead to blurry vision, and in serious cases, vision loss if left untreated.

- Diabetic Macular Edema (DME): A complication from diabetic retinopathy where fluid builds up in the macula. If not promptly treated, the swelling caused by DME can lead to vision distortion and loss of central vision.

- Cataracts: Lengthy exposure to high blood sugar increases the risk of cataract development. Cataracts cause blurry or distorted vision because of clouding in the eye’s natural lens.

- Glaucoma: People with diabetes are at higher risk of glaucoma, a condition where increased eye pressure damages the optic nerve. This can lead to gradual peripheral vision loss.

- Blurry vision: High glucose levels can affect the fluid levels within the eye, leading to fluctuating blurry vision.

Leaving some of these eye conditions untreated can lead to severe complications, including vision loss.

Early detection through diabetic eye exams allows your optometrist to manage these concerns promptly, preserving your vision and overall quality of life.

Who Needs a Diabetic Eye Exam?

The American Diabetes Association (ADA) recommends annual diabetic eye exams for anyone with diabetes. If you have existing vision concerns, severe diabetes, or a family history of eye conditions, your optometrist may recommend checkups more frequently.

Managing your blood sugar levels through diet, exercise, and lifestyle changes significantly reduces your risk of diabetic-related vision complications, but it doesn’t eliminate it entirely.

Even with well-managed blood sugar levels, it is possible to develop diabetes-related vision concerns because of the disease’s chronic nature.

Diabetes can cause long-term damage to blood vessels. Therefore, even periods of stable blood sugar levels may not fully reverse or prevent prior damage. Plus, even in a controlled range, blood sugar levels fluctuate, placing stress on the eye’s delicate structures.

This is why routine and annual diabetic eye exams are essential, regardless of how well your diabetes is managed.

Breaking Down Insurance Coverage

Understanding the cost of medical care is just as important as understanding what the care involves. Luckily, most types of health insurance offer some level of coverage for diabetic eye exams.

Insurance can seem complicated or tricky. Connecting directly with your provider to confirm your coverage and review your policy details is a great way to understand what vision-related expenses are covered under your plan.

This helps you stay ahead of your appointments and avoid the surprise of unexpected costs.

Private Insurance

Many private health insurance plans include vision care as part of their preventative health benefits. However, coverage can vary significantly depending on your plan. Some policies fully cover diabetic eye exams as part of chronic disease management, while others might include a co-pay or deductible.

Insurance policies can differ greatly, even within the same company. Reaching out will give you accurate details about your specific plan.

Medicare

If you’re enrolled in Medicare Part B, you’re in luck.

Medicare usually covers an annual diabetic eye exam. To qualify for this coverage, you’ll need to visit an optometrist or ophthalmologist who accepts Medicare.

Be sure to confirm your visit is coded as a diabetic eye exam, as Medicare doesn’t cover routine eye exams for glasses or contact lenses.

Veterans Health Care Programs

For veterans, VA health benefits often cover diabetic eye exams as part of their essential health services. The Department of Veterans Affairs confirms comprehensive care for those with diabetes, including monitoring for vision-related complications.

Reach out to your VA healthcare provider to confirm you’re accessing all available benefits.

Take Control of Your Eye Health

The goal for diabetic eye exams is simple: early detection. These annual visits help safeguard your vision and are vital to diabetes management.

There are insurance options to help make these exams more accessible and affordable.

Connect with our team at Great Hills Eye Care to learn if we accept your insurance plan and to schedule your diabetic eye exam.